From the Desk of the Executive Director of the Department of Retirement Services, Part 2

Quadrennial Executive Summary

Greetings to the Servants of the Most High. May this communication find you in good health and Spirit. It is important that an explanation of this quadrennial’s (rather triennial’s) odyssey be provided from an executive level view, so that the plan participants understand the priorities of the department and this administration. This So this is a summary of three years.

Around the time the 51st General Conference was ending, again that was in July 2021, all plan participants received the regular quarterly annuity statements of our fund balances. Unfortunately, it was soon discovered that those statements were not only incorrect, but that the actual fund balance was greatly different, with all assets totaling only approximately thirty precent of what had been reported.

Amidst that early turmoil, this Executive Director made four crucial decisions. First, the discovery and the discrepancy was shared and an investigation was initiated. Regarding funds under government regulation, It is a felony of “fraudulent concealment” when an alleged illegality has been discovered in an organization and remains unreported, and it is a felony of “fraudulent misrepresentation” when a statement which is known to be in question, is sent out. This first decision later cleared the church of these two charges in the early stages of the litigation.

Second, the fund was frozen. With the fund being only roughly a third of what had been reported, distributions to plan participants had to be halted. To continue to give one hundred percent distributions without those actual monies being found would have rapidly diminished the fund and left most participants, who were not retiring soon, with nothing.

Third, the fund was revalued by our third-party administrator, and all of the accounts of all of the participants was painstakingly figured and they were all reduced to the balance of actual monies on hand, which was again approximately thirty percent of what had been reported in previous statements

Fourth, the fund was re-opened and qualified distributions were reinitiated so that the plan participants could at least access the thirty percent that was available. This is the Legacy Account at Symmetry for qualified distributions of: retirement, hardship and death.

All of this was decided and executed in the Fall of 2021. So those early decisions are what assisted in putting the department in a condition that it could and did become operable. In this highly scrutinized season, thankfully to the Lord, no violations of any regulations have been cited.

While all this was occurring, the Lord was making flowers of ministry to bloom. Immediately after the end of the General Conference, The Lilly Endowment Fund approached this Executive Director and invited the department to participate in a grant to address the Economic Challenges of Local Pastors and Churches. So in these three years we have: 1) Conducted a survey to determine current pastoral challenges, 2) Partnered with the AMEC Economic Empowerment Commission and held a financial summit in Birmingham, AL, in June of 2022, 3) Initiated the Ministerial Excellence Fund, a matching grant program, which has to date received 65 applications to reduce seminary debt and medical bills of pastors totaling over $136,000 in distributions, and in July, 2024, the Executive Education Program will begin. Please watch for further announcements because Pastors will receive stipends for participating. God made provision for the vision that was given to me to “revive the stewardship component of the department to help get resources to the pastors and the churches to help them meet their obligations.”

In the Spring of 2022, the General Board Commission for the Department of Retirement Services was organized to assist the department in stabilizing. The commission with the Director and the Chair and Co-Chair of the commission met twice a month for nearly two years. Much of the work that was accomplished could not have been done without the assistance of the commission.

It has long been desired by many plan participants to get a higher return on our retirement savings. Also, the question of security for the retirement funds as we go forward was of high priority. Over five months, the commission thoroughly vetted nine finance houses through RFP responses and inquiries. Wespath Benefits and Investments was determined to best address our needs. The recommendation was approved by the Council of Bishops and the General Board. We are now enjoying the best service; security and the returns are the highest in the history of the department. In 2023, Wespath paid AME participants an average of 8% on our investments.

The Principal Life Group Insurance Plan for active pastors and spouses was scheduled to expire at the end of March, 2023, so in the Fall of 2022, in the same fashion that the commission vetted financial institutions, it vetted insurance companies through an RFI. Of the responses received, Principal Life far offered the best coverage and premium. The Council of Bishops took special care to affirm that Principal Life was the best company for us and along with the Executive Committee of the General Board, and approved the contract prior to the cancellation date. For the coverage we have with Principal Life, no premium on the market has been found that is lower than what the plan participants pay.

At this writing, after nearly three years, the department has continued to serve, and has still prospered and is finally poised to complete the transformation of the department into its new position of service. The Executive Director Recommendations in the General Conference report will provide further detail of what is envisioned for the next quadrennium.

As you are reading this, the technology of the department is already being upgraded. A contract with Docusign will allow for electronic authorization and transaction tracking. Documentation to affirm pastor’s insurance coverage is being sent to the participants at this writing. Now that we are operating, we can further improve, securing the assets of the department was determined to be the first priority of these three years, and remains so.

I hope this article explains some of the details of the journey which the populace of the plan participants may not be aware. It does not address what is in the front of most, if not all the plan participants minds, and that is the restoration of the seventy percent which participants lost through the discovery of the discrepancy of funds previously reported and those actually found. This is what is being referred to in “making the participants whole.” The responsibility for accomplishing this is in the hands of other church leadership. Personally, I hope the Lord will reveal some acceptable answer to this, because my wife and I put most of our life savings into the fund and now our future, even our present has been affected and altered by what happened.

In all of this uphill climb, the Lord has been with us all, and I believe deliverance will come from our faithful God. I would be remiss if I didn’t thank the Plan Participants for their prayers and patience in this difficult and challenging season. Thank you, Bishop Seawright, for your partnership. Thank you, Bishop White, for your wise council and support. Thank you, Bishop Zanders, for your sterling leadership and encouragement. Thank you, General Board Commission, for your arduous labor that also put you under scrutiny, but your work and our accomplishments speak for themselves. Thank you, office staff, who were the front-line responders and persevered to keep serving the participants. Thank you, family, you immediately held up my arms so that I would not get tired. And thank you God for trusting me not just to be qualified, but to be honest to the plan participants, and thank you for the strength and courage to maintain my character in this great test and pivotal time in our church history.

Please go to the department’s new website www.amecdrs.org for updates and information on the department programs. And watch for our full report, with statistical numbers and comprehensive reporting of the department’s activities at the General Conference.

I can tell you this with certainty, everything is improved from what was inherited by this administration, and with the Council of Bishops and the General Board Commission’s continued support, the inequities of this department will be resolved. Amen everybody.

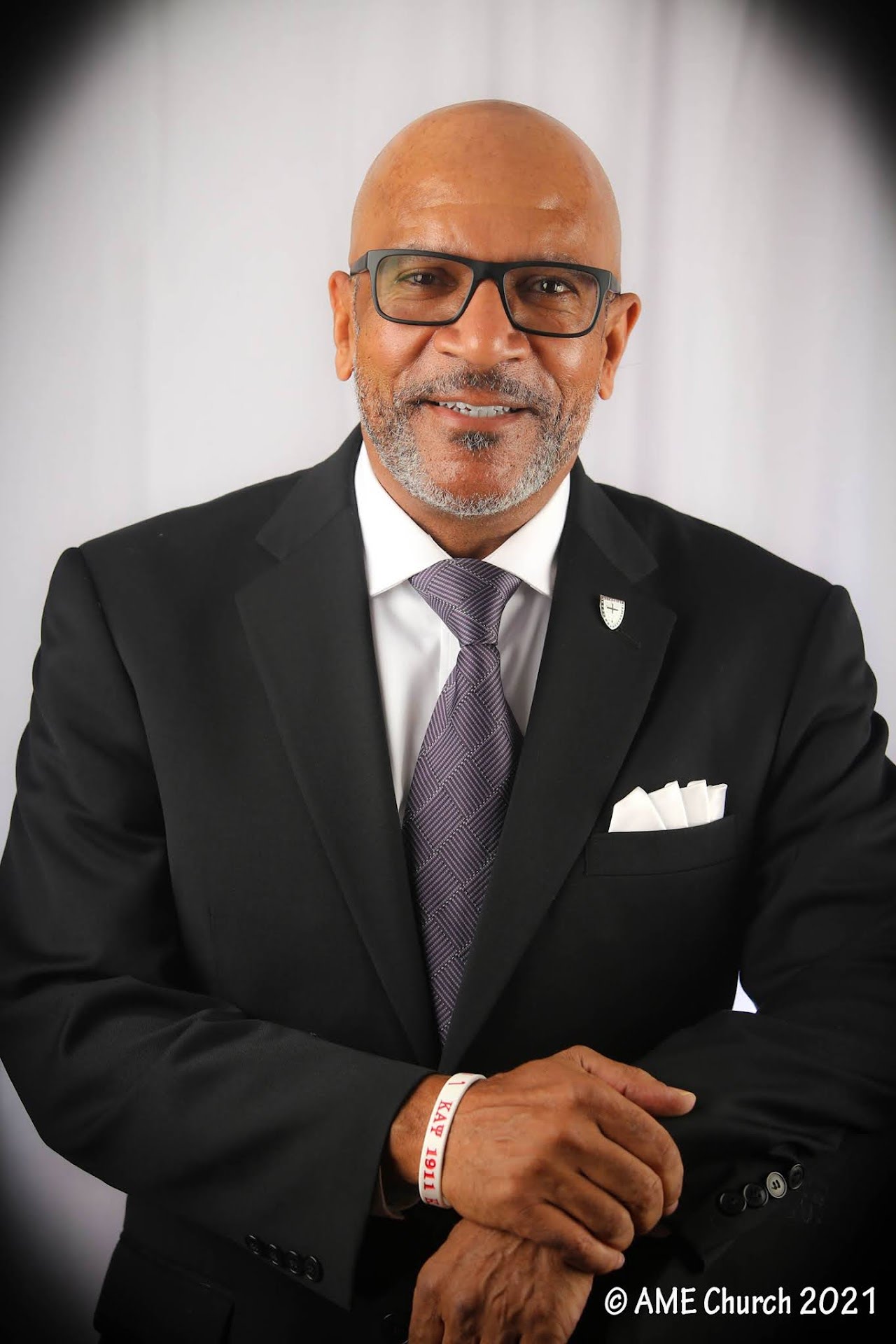

Dr. James F. Miller, Executive Director

Department of Retirement Services

Dear Executive Director Miller,

I appreciate your open letter report. From what l am reading, your report demonstrates an improvement from what it was before you came on board.

The system that was in place over the years, appears to be the same system still in place, with the external providers reporting to the same set-up as before. The trouble l have within your report, that it lacks a clear demonstration that the players have change.

I appreciate your wonderful remarks and will wishes of the current leadership in place. However, allow me to remain you, this is no new set-up, but a restart.

Until there is an arm length distance between the AME Church retirement, that seats non-invested overseeing persons, who are not reporting to the groups, as you mentioned in your report, the real possibility of true oversight remains in question.

When you experience what has happened in the AME Church, most businesses make a notable change to protect any possibility of a repeat

Respectfully offered,

Dr. Bobby Sisk, MBA, DM.